Page 55 - Mazars Central and Eastern European tax guide 2023

P. 55

Uzbekistan Excise Tax is paid by importers or sellers of:

1) Alcoholic products

2) Tobacco products

3) Oil & gas products

4) Motor vehicles.

Mazars

8A Afrosiab street, office 501, 5 Personal income tax / Social security system

th

floor “Dmaar Plaza” Business Center, Tax residents shall be recognised as an individual staying

Tashkent – Uzbekistan in the Republic of Uzbekistan for at least 183 calendar

Phone: +998 93 373 11 40 days in any consecutive 12-month period ending in the

E-mail: infoca@mazars.kz

current tax period (calendar year). The concept is the same

as worldwide.

12% Social Tax contains all type of contributions to the

social system, including pension scheme and access to the

Corporate taxes and other direct taxes WHT applies to incomes paid to non-residents that are state medical system.

not registered for tax purposes in Uzbekistan. The taxable

In general, the concept is similar to the CIT concept incomes are listed in the Tax Code. Uzbekistan has signed

in developed countries worldwide. Taxable income 54 Treaties on Avoidance of Double Taxation. The treaty

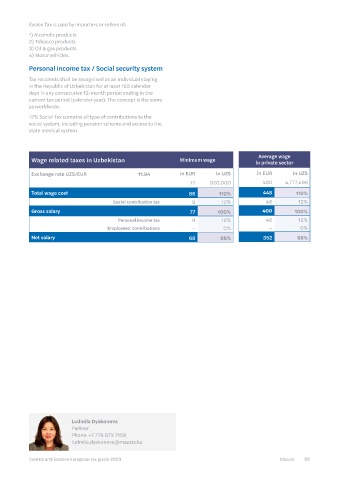

is calculated as annual income minus expenses. It is only rates prevail over the Tax Code, however it is important Wage related taxes in Uzbekistan Minimum wage Average wage

possible to deduct properly documented expenses to have a duly issued tax residency certificate for the non- in private sector

provided that the expenses are connected with the taxable resident to apply the treaty. The Multilateral instrument Exchange rate UZS/EUR 11.94 in EUR in UZS in EUR in UZS

income. Dividends and capital gains are excluded from (MLI) is not in force.

taxable income. Percentage of depreciation norms for fixed 77 920,000 400 4,777,496

assets is fixed in the Tax Code and by substance is similar Small and medium businesses may enjoy a special tax Total wage cost 86 112% 448 112%

to IFRS principles. Loss carry forward is available without regime according to which the Unified Tax on income Social contribution tax 9 12% 48 12%

any limits in amount and time. The rules on carry forward is paid. Such tax replaces CIT.

of losses do not apply to losses generated during periods Gross salary 77 100% 400 100%

when a company has enjoyed tax benefits. There are thin VAT and other indirect taxes Personal income tax 9 12% 48 12%

capitalization rules. A CFC rule exists. Employees' contributions – 0% – 0%

The VAT concept is quite similar to the concept applied

in developed countries worldwide. The turnover subject Net salary 68 88% 352 88%

Transfer pricing in Uzbekistan to VAT is in general the total value of sales (Output VAT).

Arm’s length principle ü Since 2020 The VAT paid to suppliers (input VAT) is deducted from

Documentation liability ü Since 2022 Output VAT. Input VAT cannot be offset if the goods, works,

or services purchased are not related to taxable turnover,

APA ü Since 2022 the VAT-invoice is not issued by a supplier or issued with

Country-by-Country – the violation of the legal requirements, the supplier

liability No is declared by a court to be inactive entity, etc. The VAT rate

Master file-local file for export of goods is 0% and there is certain procedure for

(OECD BEPS 13) No – the refund of the related input VAT.

applicable

Penalty

VAT options in

lack of documentation ü Less than 500 EUR. Uzbekistan Applicable / limits

tax shortage ü 40% of tax shortage Distance selling No

Legal entities are considered

to be interrelated: Call-off stock No

- legal entities if one legal

entity directly or indirectly VAT group registration No

participates in another legal

entity and the share of such Cash accounting – yearly No

participation in the charter amount in EUR (approx.)

Related parties capital exceeds 20% Import VAT deferment

- an individual and a legal No

entity, if the individual directly Local reverse charge

or indirectly participates ü

in the legal entity and the Option for taxation

share of such participation

in the authorised capital letting of real estate No

exceeds 20%.

Safe harbours No – supply of used real estate No

Level of attention paid by Tax VAT registration 1 bUZS (approx. 83 kEUR) Ludmila Dyakonova

Authority 7/10 threshold Partner

Phone: +7 778 873 7159

ludmila.dyakonova@mazars.kz

54 Mazars Central and Eastern European tax guide 2023 Central and Eastern European tax guide 2023 Mazars 55